Thursday Briefing: From DXY. Gold to Latest FX Headlines; March 28, 2024

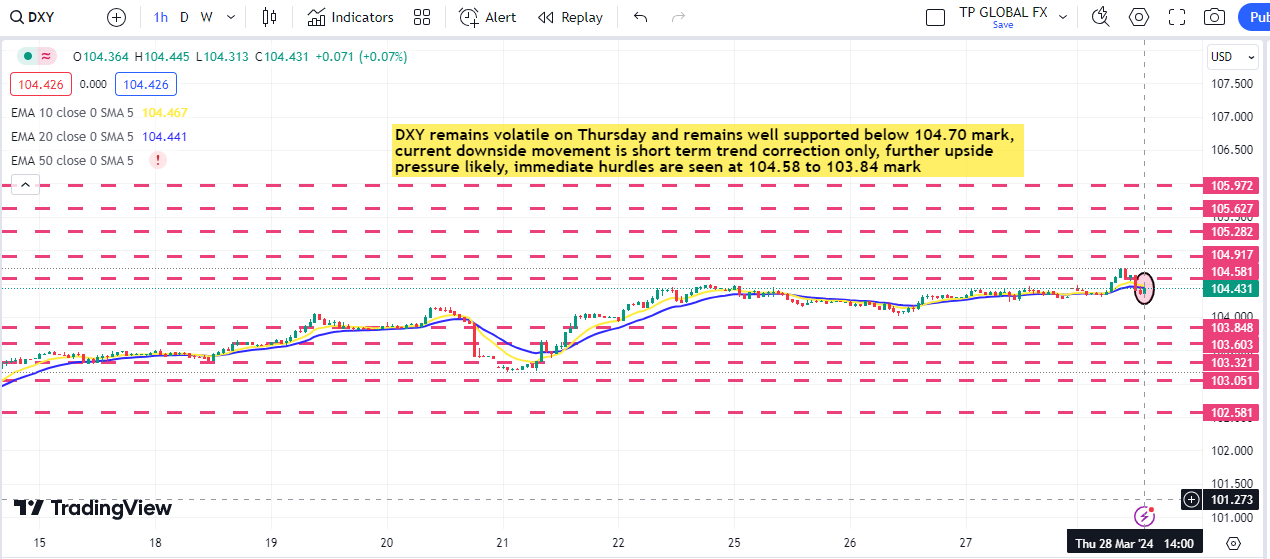

US Dollar Index Overview

- DXY trades directionless on Thursday and hovers around 104.50 mark.

- It made intraday high at 104.72 and low at 104.31 mark.

- A day Chart is up and H1 chart with triple EMA suggests downside movement for the time being.

- Immediate hurdles are seen at 104.58 to 103.84 mark.

- A sustained close of either side on H1 chart requires for the further directions of the U.S. dollar.

Technical Analysis: XAU/USD (Gold)

- Gold spikes up sharply and jumps back above $2,200 mark.

- The pair made intraday high at $2,217 and Low at $2,187 mark.

- A day chart and H1 chart with triple EMA suggest up trend for the time being.

- A sustained close above $2,215 on H1 chart requires for the downside rally.

- Alternatively, a consistent close below $2,202 on H1 chart will test further supports.

Key Headlines for the FX market:

- Canada GDP m/m stands at 0.6 pct vs -0.1 pct previous release.

- U.S. unemployment Claims weekly stands at 210K vs 212K previous release.

- U.S. Pending Home Sales stand at 1.6 pct vs -4.7 pct previous release.

- President Joe Biden will get a boost from Barack Obama and Bill Clinton, along with Stephen Colbert, Lizzo and Queen Latifah, at a New York fundraiser slated to raise more than $25 million and add some oomph to his 2024 re-election campaign.

- Israeli soldiers have been posting photos and videos of themselves toying with underwear found in Palestinian homes, creating a dissonant visual record of the war in Gaza as a looming famine intensifies world scrutiny of Israel’s offensive.

- Ireland said it would intervene in South Africa’s genocide case against Israel, in the strongest signal to date of Dublin’s concern about Israeli operations in Gaza since Oct. 7.

- Russia has no designs on any NATO country and will not attack Poland, the Baltic states or the Czech Republic but if the West supplies F-16 fighters to Ukraine then they will be shot down by Russian forces, President Vladimir Putin said.

- The Philippines will implement countermeasures proportionate and reasonable against “illegal, coercive, aggressive, and dangerous attacks” by China’s coastguard and maritime militia in the South China Sea, President Ferdinand Marcos Jr. said.

- The US stock market is off to a soaring start in 2024, as optimism over the economy and interest rate cuts has combined with exuberance about the business opportunity in artificial intelligence to stir up a potent cocktail for equities.

- China aims to be a strong driving force for the world economic recovery this year, opening its markets wider to foreign investors and promoting high quality growth, the country’s top legislator Zhao Leji said.

- Official figures confirmed Britain’s economy entered a shallow recession last year, leaving Prime Minister Rishi Sunak with a challenge to reassure voters that the economy is safe with him before an election expected later this year.

- The corporate exodus from Russia since its 2022 invasion of Ukraine has cost foreign companies more than $107 billion in writedowns and lost revenue, a Reuters analysis of company filings and statements showed.

- Oil prices will gain some momentum this year as demand picks up and output curbs by the OPEC+ producer group continue to squeeze supply that is already being pressured by military conflicts, a Reuters poll showed on Thursday.

- The U.S. stock market is off to a soaring start in 2024, as optimism over the economy and interest rate cuts has combined with exuberance about the business opportunity in artificial intelligence to stir up a potent cocktail for equities.

- Global smartphone shipments are expected to rebound 3% this year as easing inflation aids a demand recovery in emerging markets and the integration of generative AI attracts buyers to premium devices, a report by Counterpoint Research said on Thursday.

- The Dutch government is expected to lay out initial plans on Thursday to keep the country’s largest company ASML , from moving operations outside the Netherlands over concerns ranging from anti-immigration policies to infrastructure problems.

- Inflows into the nine recently launched exchange-traded funds (ETFs) tied to bitcoin have resumed their upward trajectory this week after the cryptocurrency’s price bounced back from its dip last week.

Keep an eye open for the latest news and fundamentals affecting the FX markets.

Take a look and do trade wisely!

Good Luck

TPGLobal

Share on facebook

Share on linkedin

Share on twitter

Share on telegram

Share on whatsapp